Get this template

Cashless

Mobile App

Company

Shrink

My Role

Design Lead

Tools

Figma Framer Arc Notion

Timeline

2020 – 2021

Description

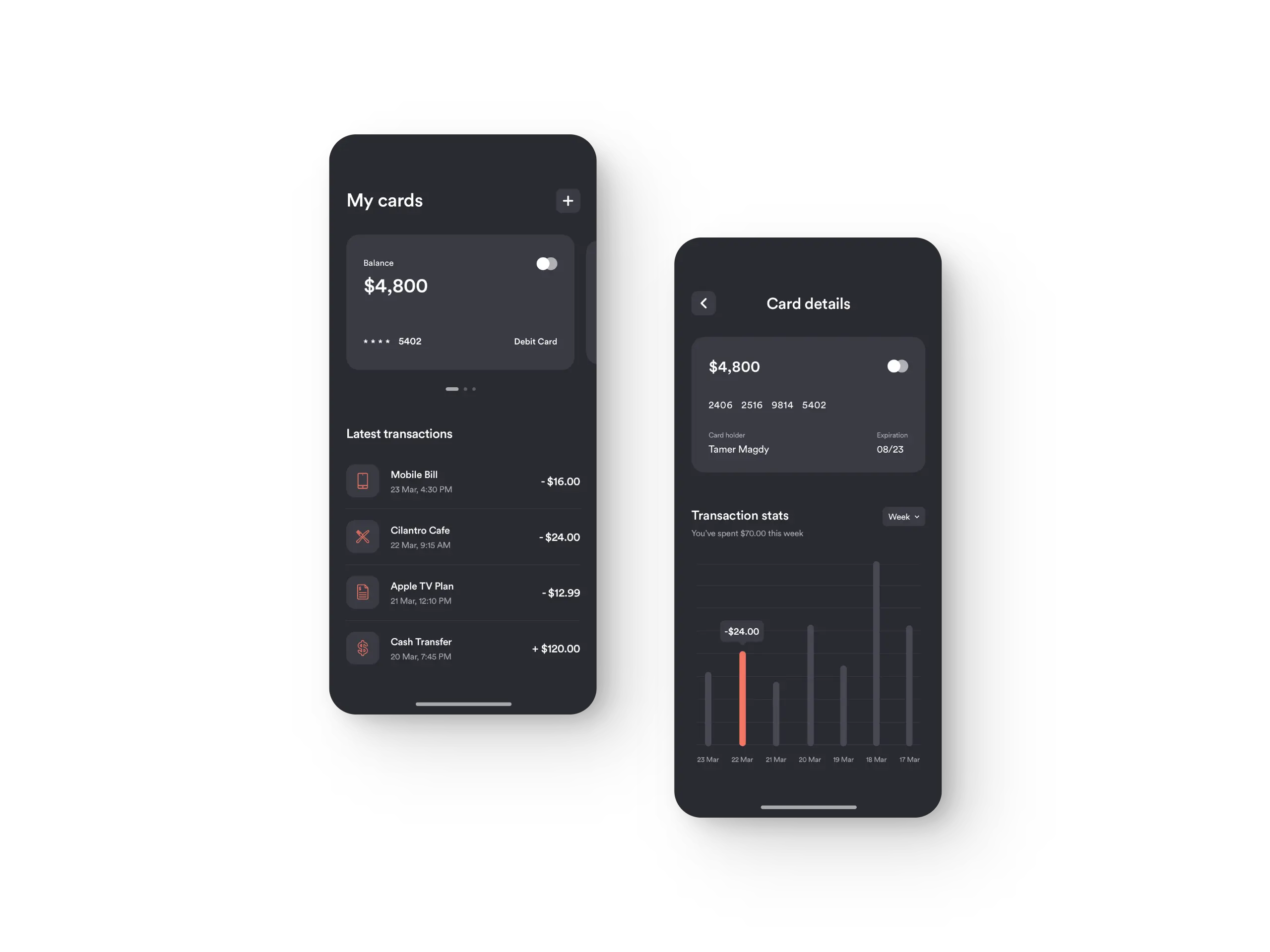

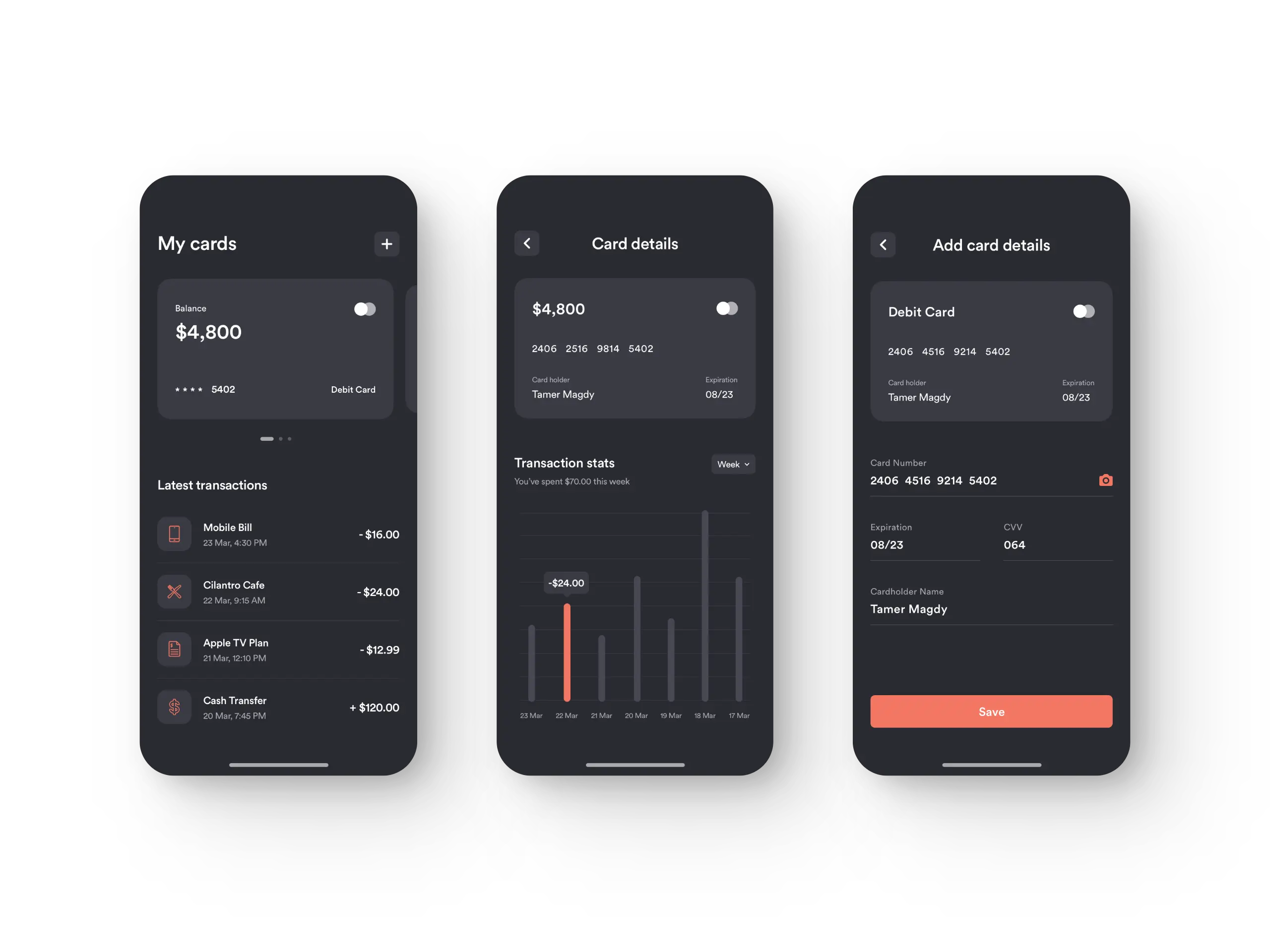

Managing finances with tools for tracking expenses and budgeting.

Context

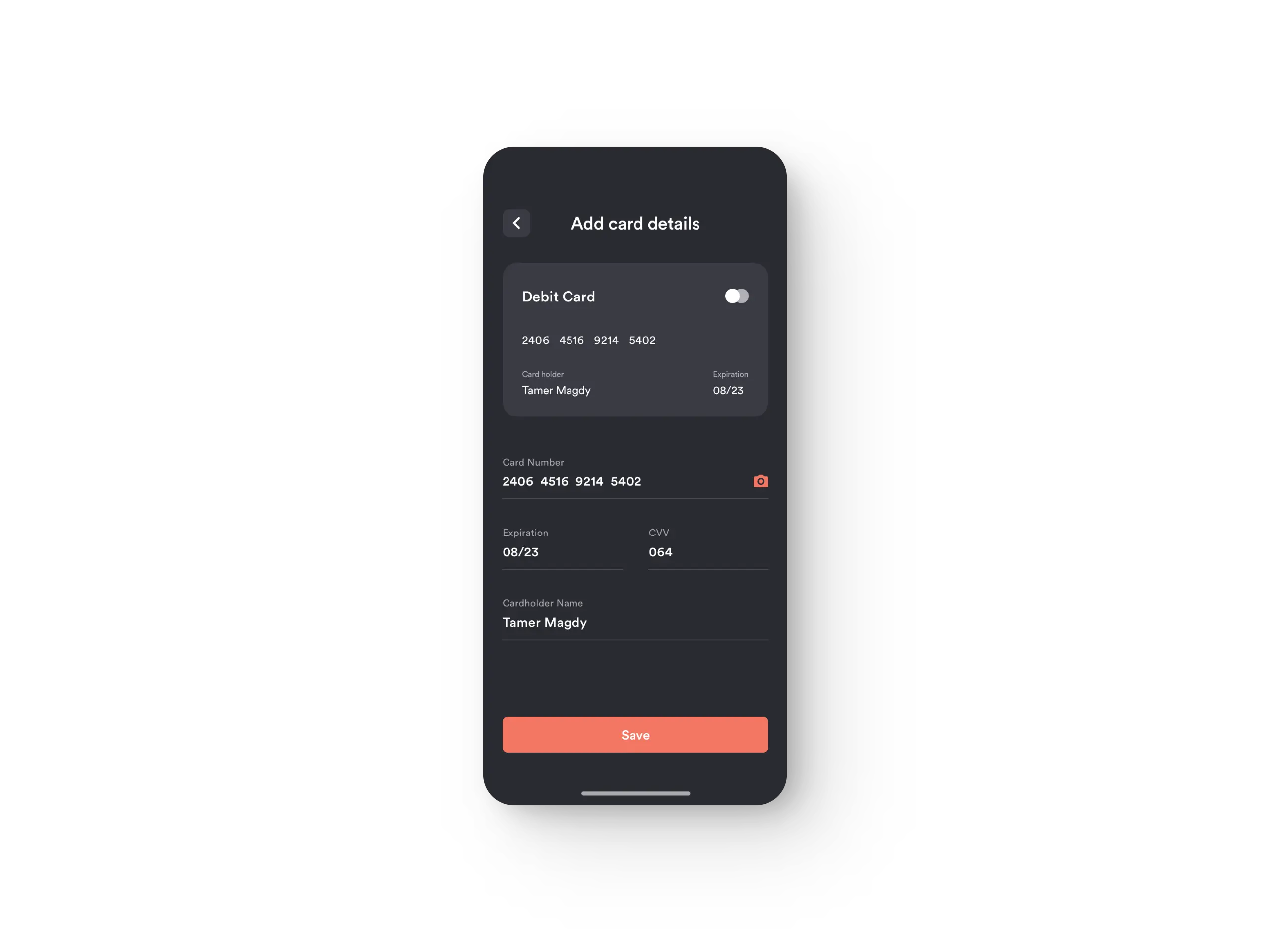

An app that is a powerful tool designed to help users manage their financial responsibilities effectively. The app offers a range of features, including credit card tracking, transaction management, subscription and bill management, expense control, and budgeting tools.

Problem

As people have many financial obligations, they require a single platform to assist in managing their finances effectively. This platform should help limit unnecessary expenses and enable users to reach their financial objectives. The obstacle was to develop a mobile application that is user-friendly, intuitive, and packed with features to cater to these diverse financial requirements while ensuring a seamless user experience.

Process

We've adopted a user-centric approach, iterative design, and rigorous testing, ensuring that the app met the target audience's needs and preferences effectively.

We've conducted studies with our audience's finances and preferences through surveys and research, giving us valuable insights.

The team created wireframes and prototypes based on research insights, refining the designs with user feedback to improve the overall user experience.

Testing the app with users and used their feedback to improve usability and design.

Solution

The app's user-friendly interface and intuitive design make it easy for users to track their financial activities in real-time, view their transaction history, and receive alerts for upcoming bills and payments. Users can also set budget goals and receive personalized financial advice based on their spending patterns, helping them stay on track and achieve their financial objectives.

Key Insights

The app's success was due in part to its user-centric design process. The team conducted extensive research and user testing to ensure that the app met users' needs and preferences, resulting in a highly effective and user-friendly platform.